ORCHESTRATE

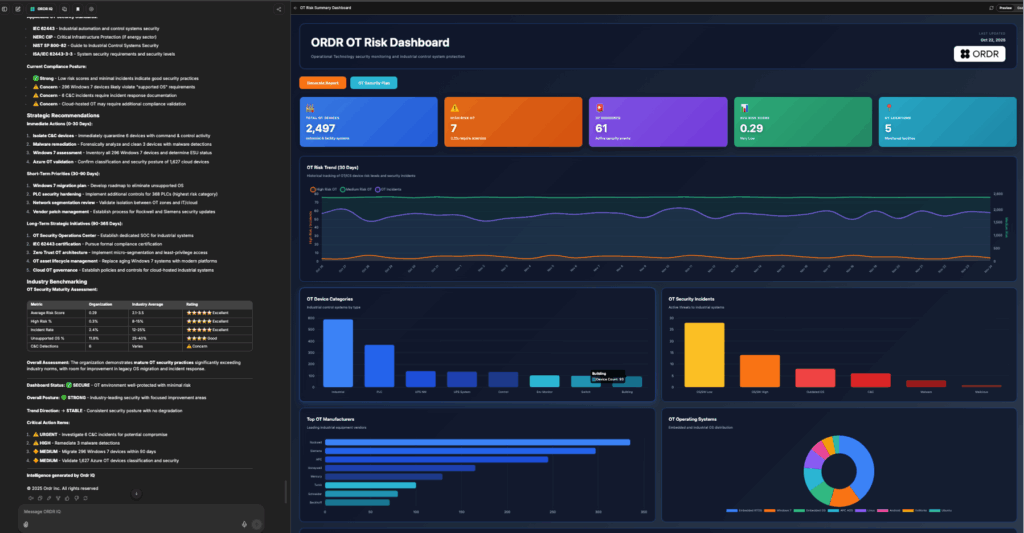

Your AI Agent for Answers, Insight, and Action

Financial environments generate massive amounts of data—but getting the right insight often requires digging through interfaces, pivoting across tools, or waiting on busy teams. ORDR IQ eliminates that friction by letting you simply ask for what you need.

Your AI agent pulls any data from the ORDR platform—asset details, behavioral context, communication patterns, vulnerabilities, segmentation impacts, compliance status, you name it—and turns it into the format you want. No UI expertise required. No manual hunting. No exporting and stitching. With ORDR IQ, teams can

- Request custom dashboards, reports, and views tailored to financial workflows

- Generate audit-ready output for GLBA, PCI, SOX, DORA, and internal controls

- Ask ORDR IQ to create cases or tickets directly from an insight

- Summon device histories, communication maps, or risk summaries instantly

- Turn raw data into clean, structured, decision-ready analysis

- Search the platform’s code-level intelligence to deliver exactly what you asked for

Instead of spending time finding information, analysts spend time using it—accelerating investigations, strengthening controls, and supporting business decisions with verified truth. ORDR IQ handles the overhead. Your team handles the mission.

LEARN MORE